Introduction

When considering becoming a policyholder, commencing your journey on the right path is of utmost importance. Choosing from the cream of the crop in the financial industry ensures a solid foundation for your insurance needs. In this article, we present an exclusive list of the top 10 insurance companies, meticulously curated to aid you in making an informed decision backed by vital details and credentials.

In this article, we would be comparing these companies with information like their Networth, Current CEOs, Policies, Professional Practices and recent developments. So, lets get to it.

1. USAA (United Services Automobile Association):

Starting with a little history, this company was founded in 1922. The establishment of USAA was in response to the challenges faced by military officers in obtaining auto insurance. At that time, many insurance companies considered military personnel to be high-risk customers due to the frequent relocations and dangerous nature of military service. As a result, they either refused to provide insurance to military officers or offered policies at exorbitant rates. In light of this situation, a group of 25 Army officers decided to pool their resources and form their own insurance association to provide coverage specifically tailored to the needs of military personnel. The founding members each contributed $20 to start the association, and USAA began its operations with the aim of offering affordable and reliable auto insurance to its members. Over the years, USAA expanded its offerings to include various insurance products and financial services, all designed to cater to the unique needs of military members, veterans, and their families. Today, USAA is renowned for its exceptional customer service and commitment to serving the military community, making it one of the most trusted and respected insurance providers in the United States. Below are the names of the offices that were involved in this success story.

Currently the company is under the rulership of Wayne Peacock who is currently the president and chief executive officer of the company. USAA has maintained a strong net worth of $27.4 billion, preserving USAA’s ability to serve and support members and the association, and revenue was $36 billion in contrast to a net worth of Approximately $35.5 billion (as of 2020).

As USAA primarily serves military members and their families, it may not have as much presence in offering insurance products to the general public or non-military-affiliated individuals hence if you are not part of the 0.5% of the US population that makes up the military, you can forget using USAA as you insurance provider.

If you are sure you are a veteran, a Military personnel or a military-affiliated individual, then you can click get quotes button to proceed to their website and see what you can find.

25 Officers

- Captain William Alexander.

- Lieutenant Colonel Monte B. Mitchell.

- Captain Walter R. Jones.

- Major Ernest F. Hardaway.

- Lieutenant Colonel Lewis R. Armstrong.

- Captain Roger W. Brown.

- Captain Jack L. Hines.

- Major James M. Lifsey.

- Lieutenant Colonel Augustus C. Bennett.

- Lieutenant Colonel William W. Arnold.

- Captain W.M. Thornton.

- Lieutenant Colonel J.A. Nix.

- Lieutenant Colonel W.A. Barron.

- Lieutenant Colonel Arthur F. Kramer.

- Lieutenant Colonel C.C. Burton.

- Major Charles G. Norton.

- Captain William K. Butler.

- Major William E. Crenshaw.

- Major Robert G. Arnold.

- Major Walter J. Mix.

- Captain W.J. Ham.

- Lieutenant Colonel Arthur T. Malcom.

- Captain Henry A. Hobbs.

- Captain H.M. Boudwin.

- Captain Harold D. Dunbar.

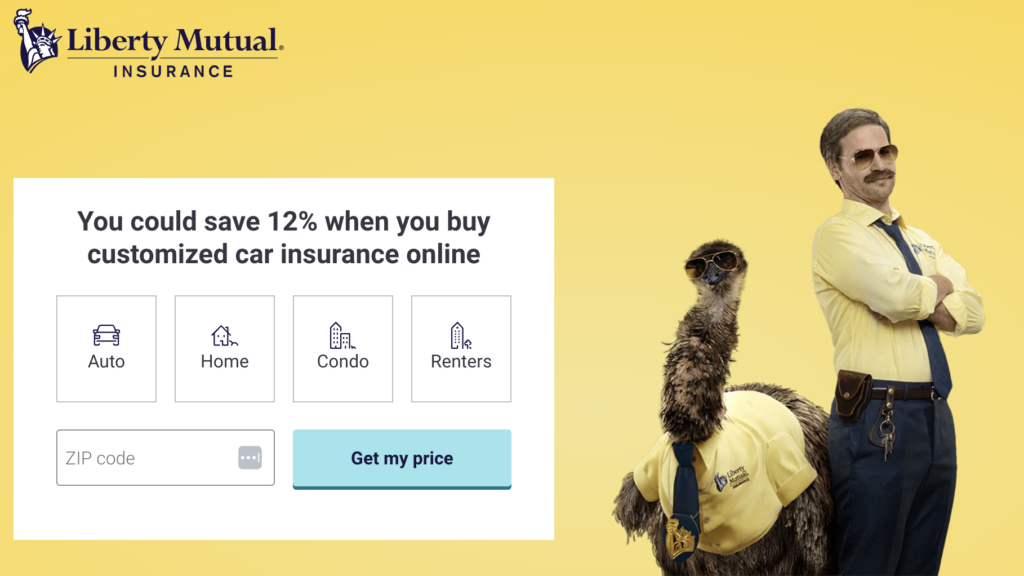

2. Liberty Mutual Insurance:

Liberty Mutual was founded in 1912 by James A. Chapman. The company’s inception was inspired by the Boston, Massachusetts, employee market’s lack of workers’ compensation insurance. Since then, Liberty Mutual has grown to become one of the largest insurance companies in the world. Liberty Mutual is headquartered in Boston, Massachusetts. It operates in multiple countries worldwide, offering various insurance products and services including auto, home, life, renters, business, and specialty insurance. They also offer coverage options for personal liability, umbrella insurance, and more. They have regional and local offices to support their operations in different regions. Wholly or in part, they own local insurance companies in Argentina, Brazil, Chile, China (including Hong Kong), Colombia, Ecuador, India, Ireland, Malaysia, Poland, Portugal, Singapore, Spain, Thailand, Turkey, the United Kingdom, Venezuela, and Vietnam.

Headquartered in Boston, They are the fifth largest global property and casualty insurer based on 2022 gross written premium. They also rank 86 on the Fortune 100 list of largest corporations in the U.S. based on 2022 revenue with a total asset worth of $156.043 billion (2021) and Equity of $27.848 billion (2021)(Visit PRNews Wire for more analytical report on Income and Net-worth). Getting down to the major reason why you’re here, You can get a quote from Liberty Mutual through their official website or by contacting their customer service.

1. Online Quote:

- Visit Liberty Mutual’s official website (www.libertymutual.com).

- Navigate to the insurance product you are interested in, such as auto, home, renters, or life insurance.

- Click on the “Get a Quote” or “Get a Quote & Buy” button, which should be prominently displayed on the page.

- Fill out the required information in the quote form. You’ll typically need to provide details about yourself (name, address, contact information), the type of coverage you’re seeking, and some information related to the insured property or individuals (e.g., vehicle details for auto insurance, home details for home insurance).

- After submitting the form, Liberty Mutual’s system will process your information, and you should receive a quote online or via email.

2. Customer Care Agent - If you prefer to speak with a representative or have specific questions about the coverage options, you can contact Liberty Mutual’s customer service directly.

- Look for the customer service phone number on their website or any promotional material.

- When you call, inform the representative that you are interested in getting a quote for the insurance type you need.

- The customer service agent will guide you through the process, ask you relevant questions, and provide you with a quote based on the information you provide.

- It’s important to keep in mind that insurance quotes can vary based on individual circumstances, coverage limits, deductibles, and other factors. Additionally, the availability of online quotes and specific procedures may have changed since my last update, so it’s always a good idea to check Liberty Mutual’s website or contact them directly for the most up-to-date information on obtaining a quote. Click the “Get Quotes” button to check their website for more details.

3. State Farm Insurance:

This one has a weird name but its considered one of the best too State Farm was founded in 1922 by George J. Mecherle, a retired farmer and insurance salesman. The company’s establishment was based on the idea of providing auto insurance to farmers at competitive rates, as Mecherle believed they were safer drivers compared to urban dwellers. He decided to establish a similar automobile insurance company that would focus on offering reliable and affordable coverage. State Farm has its headquarters located in Bloomington, Illinois. They have a significant presence across the United States, with numerous regional and local offices to support their customers. Under the rulership of CEO: Michael L. Tipsord the company has lead a net worth of $131.2 billion at the end of 2022 compared with $143.2 billion at year-end 2021 and $126.1 billion at year-end 2020. of hence they are considered the largest providers of auto, home and individual life insurance in the United States.

How do you get a quote from state farm?

- Online Quote:

- Visit State Farm’s official website (www.statefarm.com).

- Navigate to the type of insurance coverage you are interested in, such as auto, home, renters, life, or others.

- Click on the “Get a Quote” or “Start a Quote” button, which should be prominently displayed on the webpage.

- Fill out the required information in the quote form. You’ll likely need to provide details about yourself, the property or vehicle you want to insure, and any other relevant information.

- After submitting the form, State Farm’s system will process your information, and you should receive a quote online or via email.

- Contact a Local Agent:

- State Farm has a vast network of local agents across the United States. You can find a local agent by using the agent locator on State Farm’s website or through a quick internet search.

- Reach out to a nearby State Farm agent and express your interest in getting an insurance quote.

- The agent will guide you through the process, ask you relevant questions to determine your insurance needs, and provide you with a personalized quote based on the information you provide.

- Call State Farm’s Customer Service:

- If you prefer to speak with a representative directly, you can call State Farm’s customer service.

- Look for the customer service phone number on their website or any promotional material.

- Inform the representative that you are interested in getting a quote for the specific type of insurance you need.

- The customer service agent will ask you relevant questions and provide you with a quote based on the information you provide.

- Call 833-322-1987833-322-1987 to get an RV insurance quote or talk to an agent

4. Allinaz SE:

Allianz was founded in 1890, and its establishment involved the merger of multiple insurance companies. Allianz SE is a leading global financial services company headquartered in Munich, Germany. It is one of the world’s largest insurance and asset management providers. It was initially established as a marine and accident insurer. Over time, the company expanded its insurance offerings and ventured into different markets through acquisitions and strategic partnerships. Allianz offers a wide range of insurance products, including life insurance, property and casualty insurance, health insurance, travel insurance, and various other specialty insurance coverages. They cater to both individual and corporate clients, providing comprehensive insurance solutions to meet various needs.

Under the leadership of Oliver Bäte, Allianz SE net worth as of July 21, 2023 is $95.95B in contrast to their net worth of Approximately €104.4 billion (as of 2020). The company was not founded by a single individual but evolved through mergers and acquisitions over the years.

Allianz is a diverse insurance company that offers various types of coverage. However, it may not be a primary provider of specialized niche insurance policies like pet insurance or event insurance. Allianz SE provides property-casualty insurance, life/health insurance, and asset management products and services together with its subsidiaries.

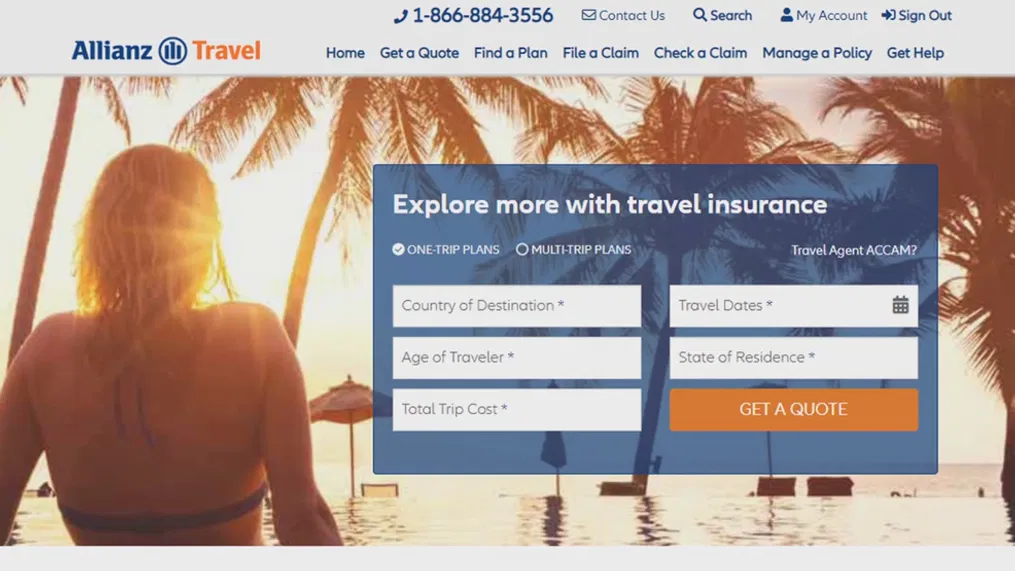

You and your family deserve the peace of mind that Allianz travel insurance provides when you travel abroad. Explore the best rates and the most comprehensive benefits worldwide. Sounds Familiar? Getting a quote from Allianaz is not so difficult. Following these steps

- Online Quote:

- Visit Allianz’s official website (www.allianz.com) or the specific website of your country or region where Allianz operates.

- Navigate to the type of insurance coverage you are interested in, such as life insurance, property insurance, health insurance, travel insurance, or others.

- Look for a “Get a Quote” or “Request a Quote” button or link on the webpage related to the insurance product you want.

- Fill out the required information in the quote form. You’ll likely need to provide details about yourself, the property (if applicable), coverage amounts, and any other relevant information.

- After submitting the form, Allianz’s system will process your information, and you should receive a quote online or via email.

- Contact Allianz Customer Service:

- If you prefer to speak with a representative directly or have specific questions about the coverage options, you can contact Allianz’s customer service.

- Look for the customer service phone number on Allianz’s website or any promotional material.

- Inform the representative that you are interested in getting a quote for the specific type of insurance you need.

- The customer service agent will guide you through the process, ask you relevant questions, and provide you with a personalized quote based on the information you provide.

- Reach Out to a Local Allianz Agent or Broker:

- Allianz operates through a network of local agents and brokers in many regions. You can find a local agent or broker through the Allianz website or other directories.

- Contact a nearby Allianz agent or broker and express your interest in obtaining an insurance quote.

- The agent or broker will meet with you to understand your insurance needs and offer suitable coverage options along with the associated quotes.

5. AXA SA:

AXA is a French multinational insurance company headquartered in the 8th arrondissement of Paris. It also provides investment management and other financial services. the multinational insurance and financial services company, was founded in 1816. The company’s origins can be traced back to the founding of the Ancienne Mutuelle, which later became part of the AXA Group. Over the years, through mergers and acquisitions of various insurance companies, AXA has evolved into one of the largest insurance providers in the world. The name AXA was adopted in 1985, representing the group’s international ambitions and a unified brand identity. Under the leadership of Thomas Buberl has a net worth of $70.84Billion as of July 21, 2023 in contrast to a Net Worth of Approximately €82.6 billion (as of 2020).

AXA does not cover specialized insurance coverage for extreme sports or adventure activities.

To get insurance quotes specifically from AXA, you can follow these steps:

- Visit AXA’s Official Website: Go to the official website of AXA or the website specific to your country or region where AXA operates.

- Select Insurance Type: Navigate to the type of insurance coverage you need, such as auto insurance, home insurance, life insurance, health insurance, travel insurance, or others.

- Request a Quote Online:

- Look for a “Get a Quote” or “Request a Quote” button or link on the webpage related to the insurance product you are interested in.

- Click on the button or link to access the quote request form.

- Fill Out the Quote Form:

- Complete the quote form with accurate and necessary information.

- You’ll likely need to provide details about yourself, the insured property or individuals, coverage preferences, and any other relevant information.

- Submit the Form:

- After filling out the required information, submit the quote form online.

- Receive the Quote:

- AXA’s system will process your information, and you should receive a quote either online or via email.

- The quote will include details of the coverage, premium costs, deductibles, and other policy information.

- Contact Customer Service or Local Agent:

- If you have any questions or need further assistance, you can contact AXA’s customer service through the provided contact information on their website.

- Alternatively, you can reach out to a local AXA agent or broker for personalized assistance.

It’s important to provide accurate information while requesting a quote to ensure the quote reflects your specific insurance needs. If you are interested in multiple insurance types, repeat the process for each type of coverage you require. Comparing quotes from multiple companies can help you make an informed decision and find the coverage that best suits your needs.